Mid-2025 Scorecard: Who’s Actually Using the Top AI Chatbots?

Data Analysis

When ChatGPT became a phenomenon in late 2022 it felt as if a single product might dominate the AI chatbot market as Google has done with search. Two and a half years on, that story is more layered and a lot more interesting for anyone thinking about AI Search optimization. We took a deep-dive into the growth trends and audiences of the top AI chatbots.

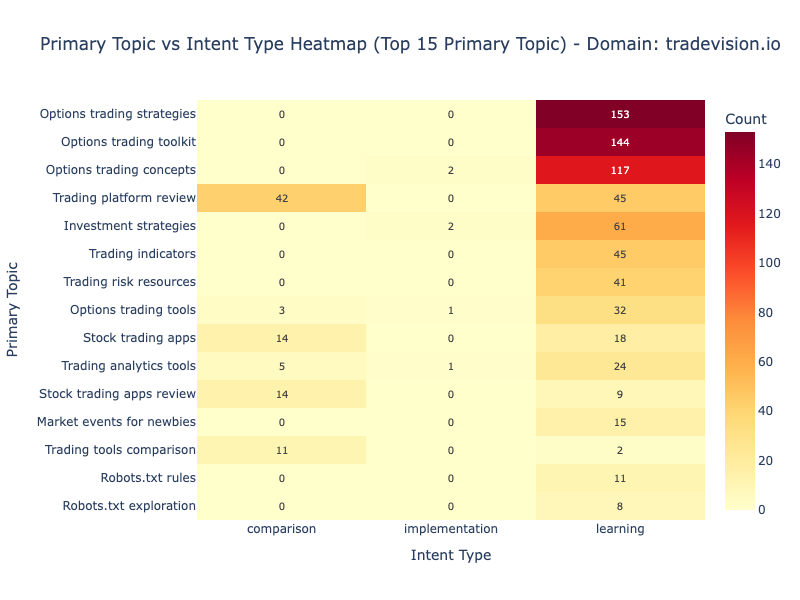

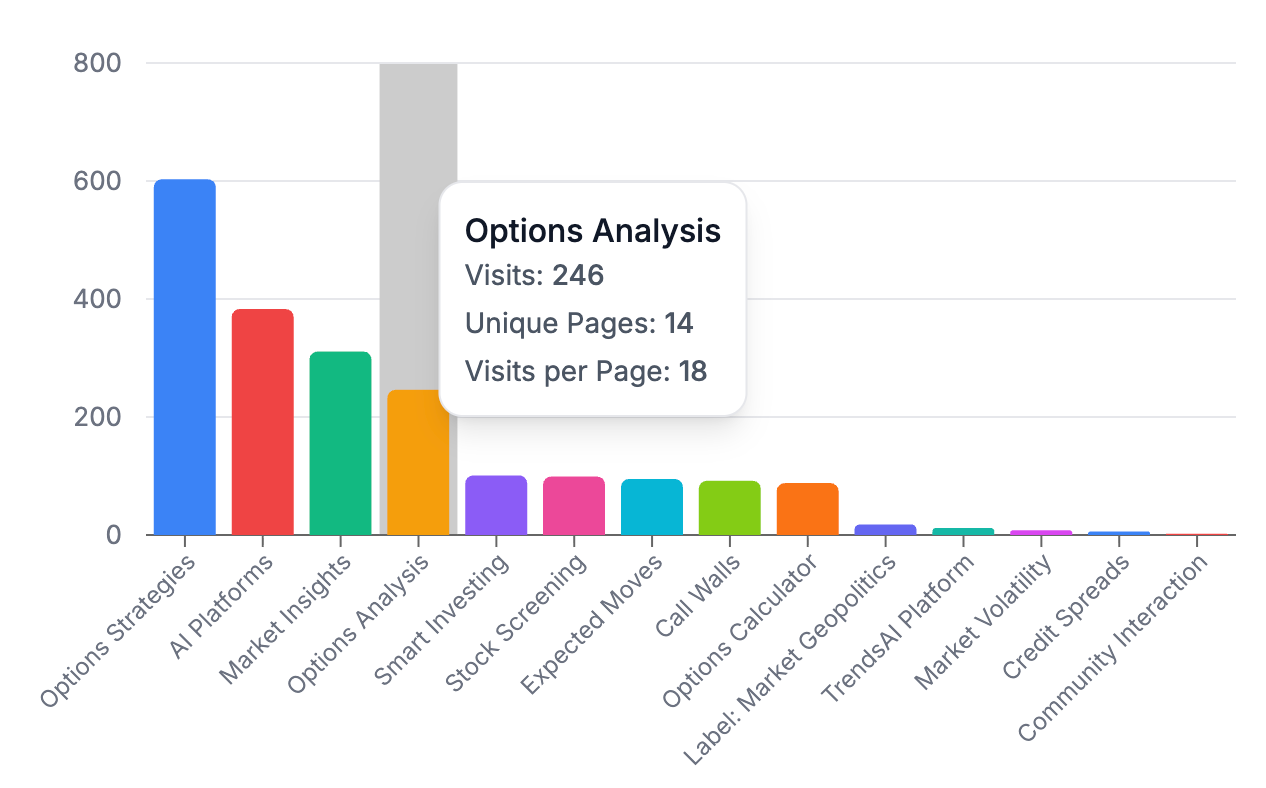

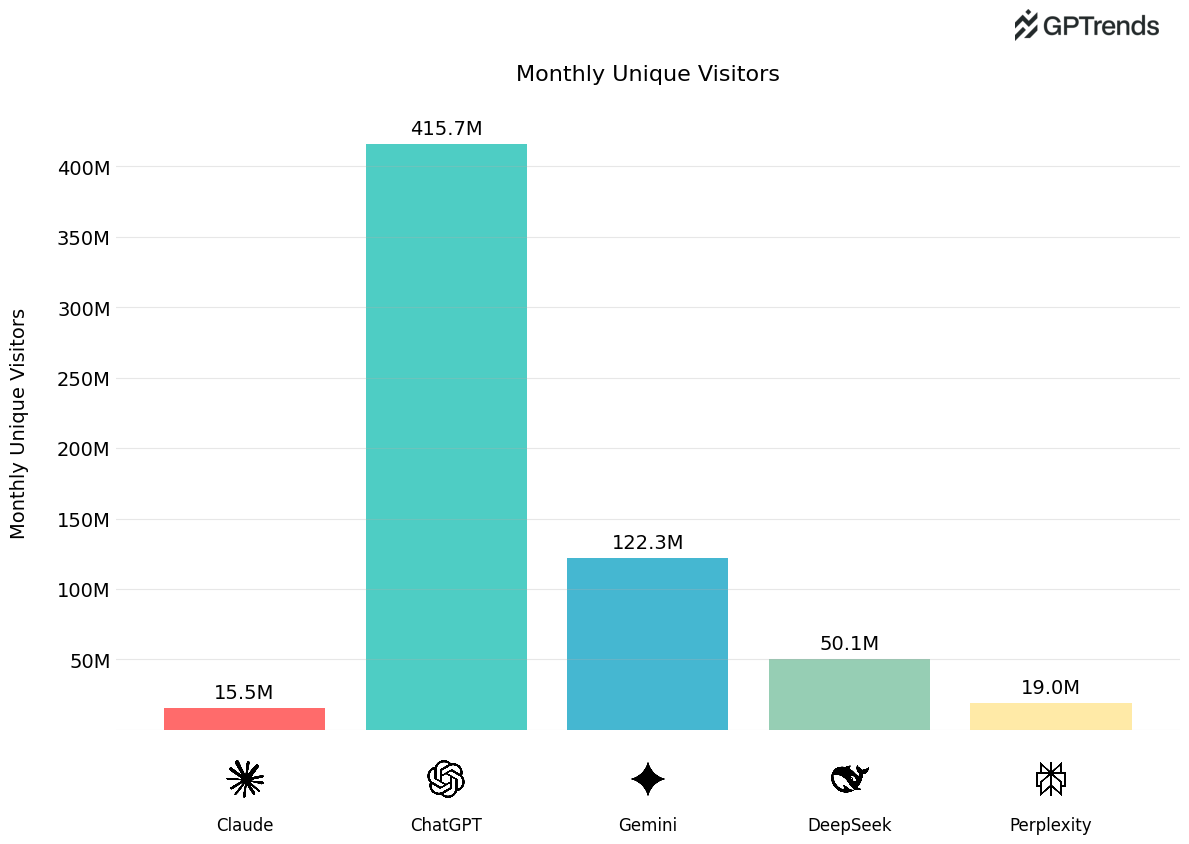

The July 2025 Leaderboard 🏆

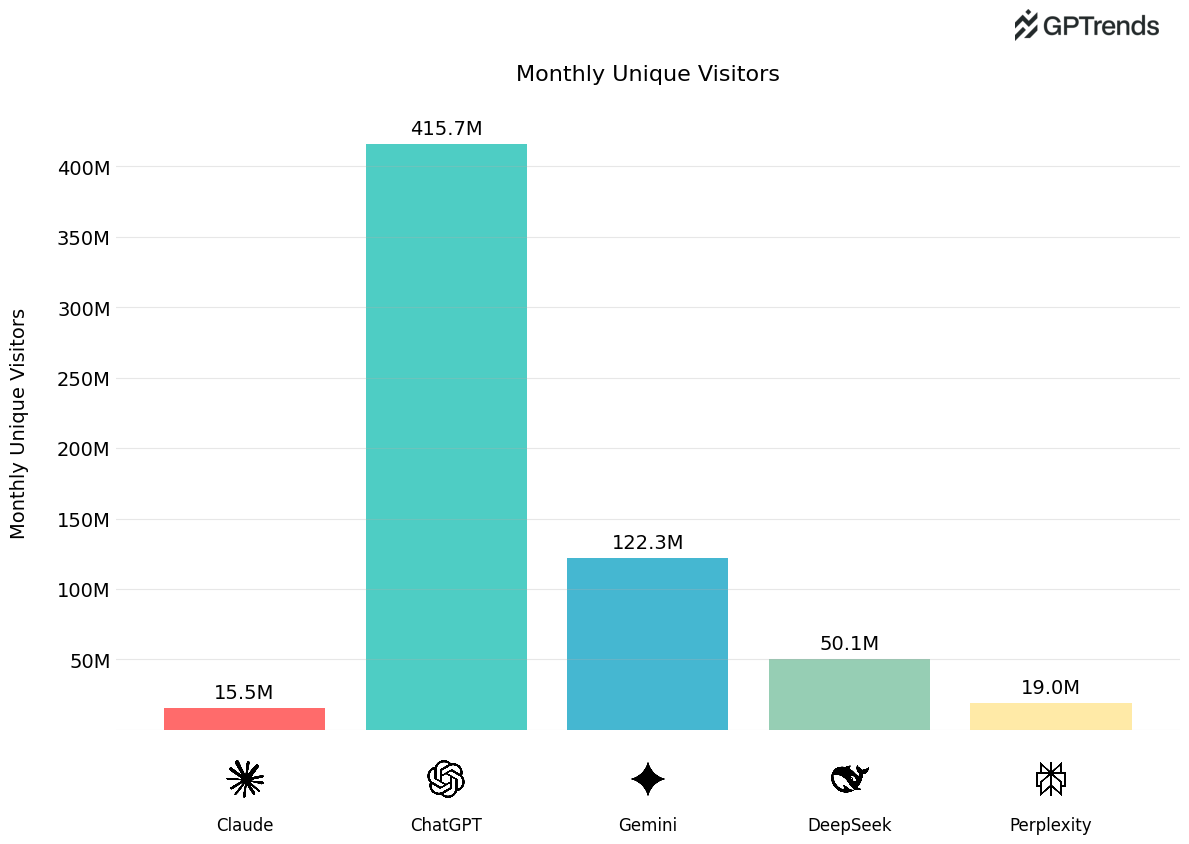

Let’s first take a look at a snapshot of current usage across the products:

| Product | Monthly uniques | Total visits | Avg. mins / visit | Pages / Session | Quick read |

|---|---|---|---|---|---|

| ChatGPT | 416 M | 5.4 B | 7.1 mins | 4.3 pages | Still the far and away leader |

| Gemini | 122 M | 650 M | 6.3 min | 3.8 pages | Reach via Google & device default deals |

| Perplexity | 19 M | 129 M | 5.4 mins | 3.9 pages | Research workhorse; depth beats breadth |

| Claude | 16 M | 113 M | 6.6 mins | 4.3 pages | Dev-heavy, large-context sweet spot |

| DeepSeek | ~50 M | 60-80 M | 4.8 mins | 3.0 pages | February rocket novelty effect has subsided |

Note: Data is desktop and mobile web only from Similarweb, does not include app visits.

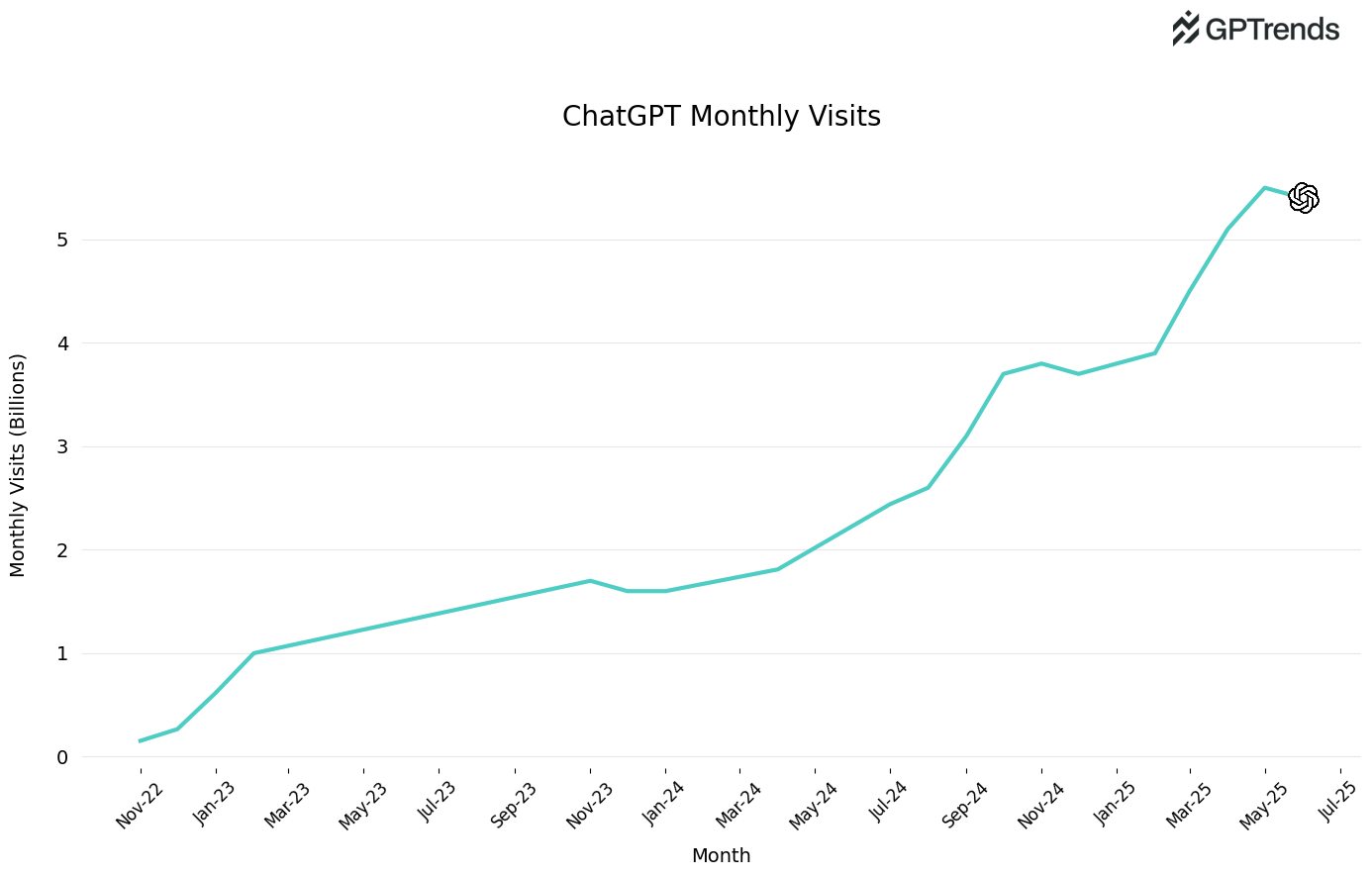

ChatGPT: Still Growing Strong After Lull Period

Traffic plateaued around 2 B visits/month last summer, but GPT-4o, voice chat, and a polished mobile app reignited the curve. June 2025 logged >5 B visits, up 160 % YoY. That puts ChatGPT at 3× the visitors of the next-closest rival in Gemini and roughly the traffic of Reddit + LinkedIn combined.

Why the second wind?

- Multimodal answers and input (images, voice) continues to unlock new use-cases new use cases.

- Workflows: code review, spreadsheet formulas, study aides seem to be forming stickiness that create daily habits.

- Brand & feature cadence: Continues to stay relevant and dominant in the news cycle with consistent feature launches

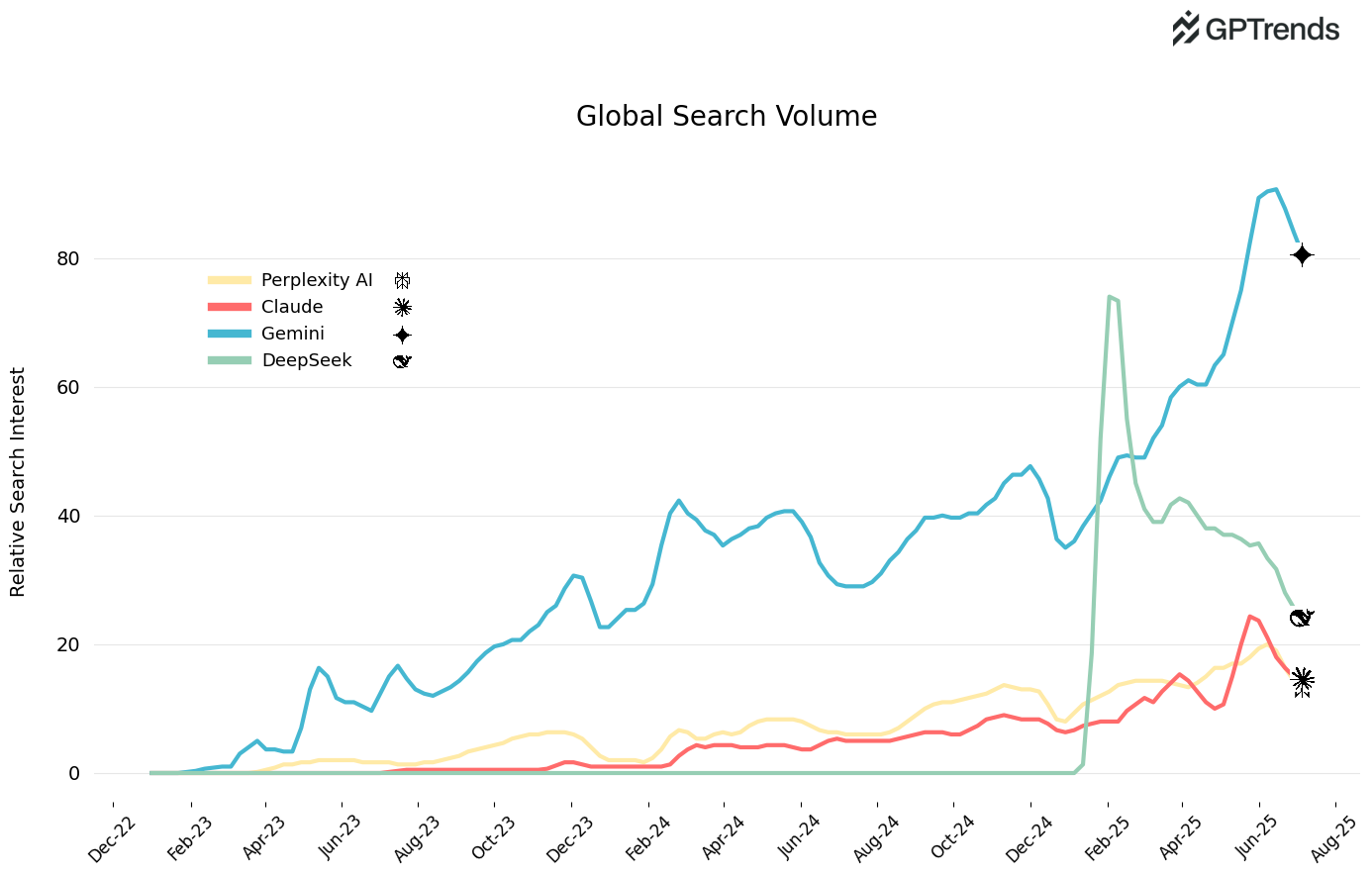

DeepSeek’s Wild Ride 🎢

In February the Chinese-made bot hit 10 M users in 20 days (twice as fast as ChatGPT’s own million-to-ten-million sprint) and briefly ranked #2 worldwide. But that momentum has faded and as of June it’s lost four-fifths of that traffic.

Not All Users Look Alike 👥

ChatGPT dominates in raw user numbers and mainstream adoption, but smaller platforms capture distinct professional and business-oriented audiences. This differentiation creates valuable platform optimization opportunities worth exploring.

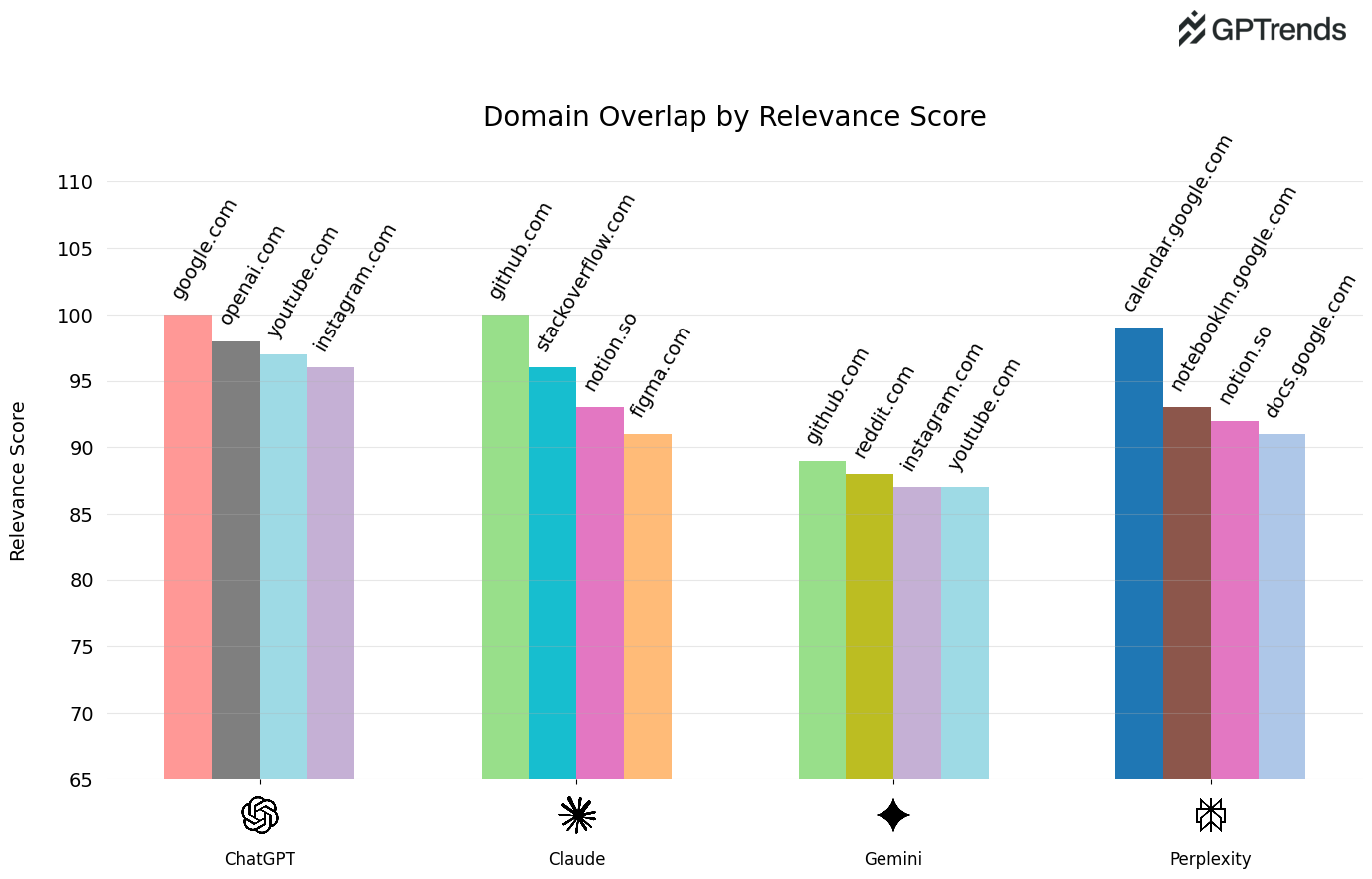

Audience Overlap Analysis

Examining user overlap with other products through Similarweb relevance scores reveals clear audience segmentation patterns. ChatGPT users overlap with broadly popular platforms like Google, YouTube, and Instagram, while Perplexity, Claude, and Gemini users gravitate toward professional tools.

Claude emerges as the clear "developer's choice," showing strong overlap with GitHub, Stack Overflow, Notion, and Figma. Gemini also attracts developers, with GitHub ranking as its top non-chatbot overlap. Perplexity skews more business-focused, with significant overlap in Google Docs and Calendar usage.

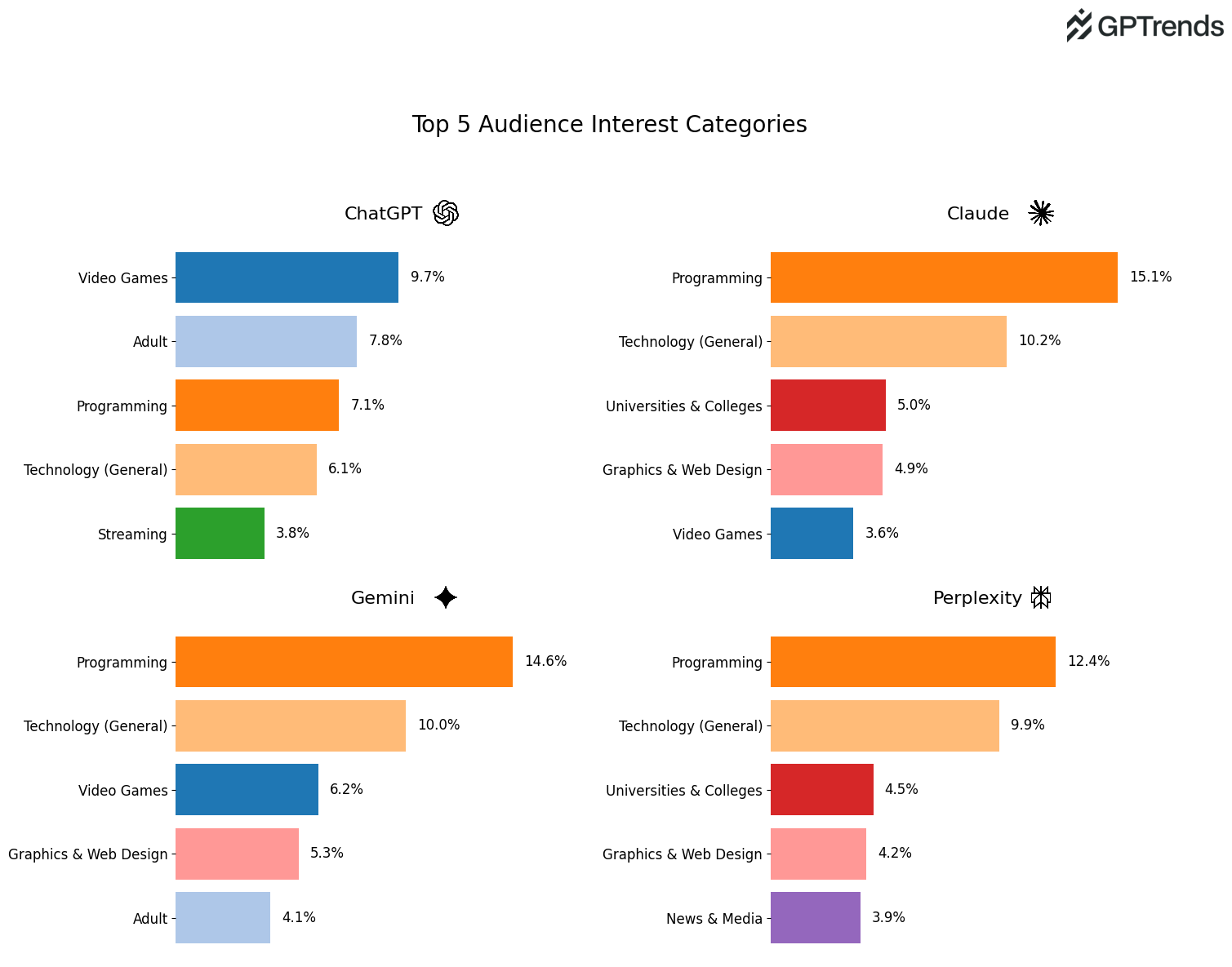

Interest Category Validation

User interest categories reinforce these product overlap findings. Programming and Technology rank as the top two categories for Gemini, Claude, and Perplexity users, confirming their professional orientation. ChatGPT users, conversely, display more typical internet user interests: Video Games, Streaming, and Adult content 🙈

This audience segmentation suggests each platform has carved out distinct professional niches despite ChatGPT's mainstream dominance.

Why This All Matters for AI Search 🔎

ChatGPT's market leadership masks an important trend: specialized platforms are capturing high-value, tech-savvy users who tend to be early adopters when it comes to discovering new products and services through AI.

Key considerations for #GEO (Generative Engine Optimization):

- Recommendation diversity creates distinct opportunities. Our previous analysis showed only 25% overlap between ChatGPT and Perplexity recommendations, meaning platform-specific optimization can capture unique visibility windows that competitors may miss.

- The 40-60% user overlap between ChatGPT and other platforms reveals complementary usage patterns as users turn to Perplexity or Gemini for specialized research or alternative perspectives after initial ChatGPT queries.

- Gemini offers compound visibility benefits. Beyond its position as the second-largest platform with a technical user base, Gemini shares a base LLM model with Google's AI Overviews and AI Mode. Optimizing for Gemini impacts both direct chatbot queries and broader Google search AI features.

The Take-Home

ChatGPT remains the gravitational centre of AI chat, but the shape of the universe is shifting. Gemini offers reach, Perplexity offers depth, Claude owns the dev crowd, and even DeepSeek proves lightning can strike outside Silicon Valley.

For brands, the prescription is simple: Track, measure, and iterate across multiple engines. The companies that treat #GEO as a diversified portfolio, rather than a single-platform play, will capture the compounding visibility that the next wave of AI search delivers.

Want to take the next step? Gemini tracking is now avilable on GPTrends along side ChatGPT, Google AIO and Perplexity.

👉🏻 Get started with a free trial today: Sign Up

Discover more